All Categories

Featured

Table of Contents

- – Top Accredited Investor Secured Investment Opp...

- – Exceptional Venture Capital For Accredited Inv...

- – Professional Real Estate Investments For Accr...

- – First-Class Accredited Investor Investment Re...

- – Investment Platforms For Accredited Investors

- – High-Quality High Yield Investment Opportuni...

It's crucial to comprehend that accomplishing recognized capitalist status is not an one-time success. It's as a result vital for accredited financiers to be aggressive in checking their monetary circumstance and updating their records as necessary.

Failing to meet the ongoing standards might lead to the loss of accredited financier status and the linked benefits and possibilities. While a lot of the financial investment types for Accredited Investors coincide as those for anybody else, the specifics of these investments are typically various. Private placements describe the sale of safety and securities to a choose team of accredited investors, commonly beyond the general public market.

Exclusive equity funds pool resources from accredited investors to obtain ownership risks in companies, with the objective of enhancing efficiency and producing substantial returns upon exit, normally with a sale or first public offering (IPO).

Market changes, home management obstacles, and the prospective illiquidity of genuine estate properties need to be thoroughly assessed. The Securities and Exchange Payment (SEC) plays an important role in managing the activities of certified capitalists, who need to abide by specifically outlined policies and reporting requirements. The SEC is accountable for implementing safety and securities legislations and laws to shield financiers and keep the integrity of the economic markets.

Top Accredited Investor Secured Investment Opportunities

Guideline D supplies exemptions from the enrollment demands for sure private placements and offerings. Certified financiers can join these excluded offerings, which are typically included a restricted variety of sophisticated capitalists. To do so, they need to offer precise information to companies, full needed filings, and follow by the regulations that regulate the offering.

Conformity with AML and KYC demands is vital to maintain standing and access to numerous financial investment chances. Failing to comply with these policies can cause extreme penalties, reputational damage, and the loss of accreditation benefits. Allow's disprove some usual mistaken beliefs: A typical mistaken belief is that recognized capitalists have actually an assured benefit in terms of financial investment returns.

Exceptional Venture Capital For Accredited Investors

Yes, accredited capitalists can shed their condition if they no more meet the eligibility requirements. For instance, if an approved capitalist's revenue or web worth falls below the designated limits, they might shed their accreditation - exclusive investment platforms for accredited investors. It's important for accredited financiers to consistently evaluate their financial situation and report any type of changes to ensure compliance with the policies

However, it relies on the specific financial investment offering and the laws governing it. Some financial investment chances may enable non-accredited capitalists to take part through particular exceptions or arrangements. It's important for non-accredited financiers to meticulously examine the terms and problems of each investment possibility to identify their qualification. Remember, being a recognized capitalist comes with opportunities and obligations.

Professional Real Estate Investments For Accredited Investors

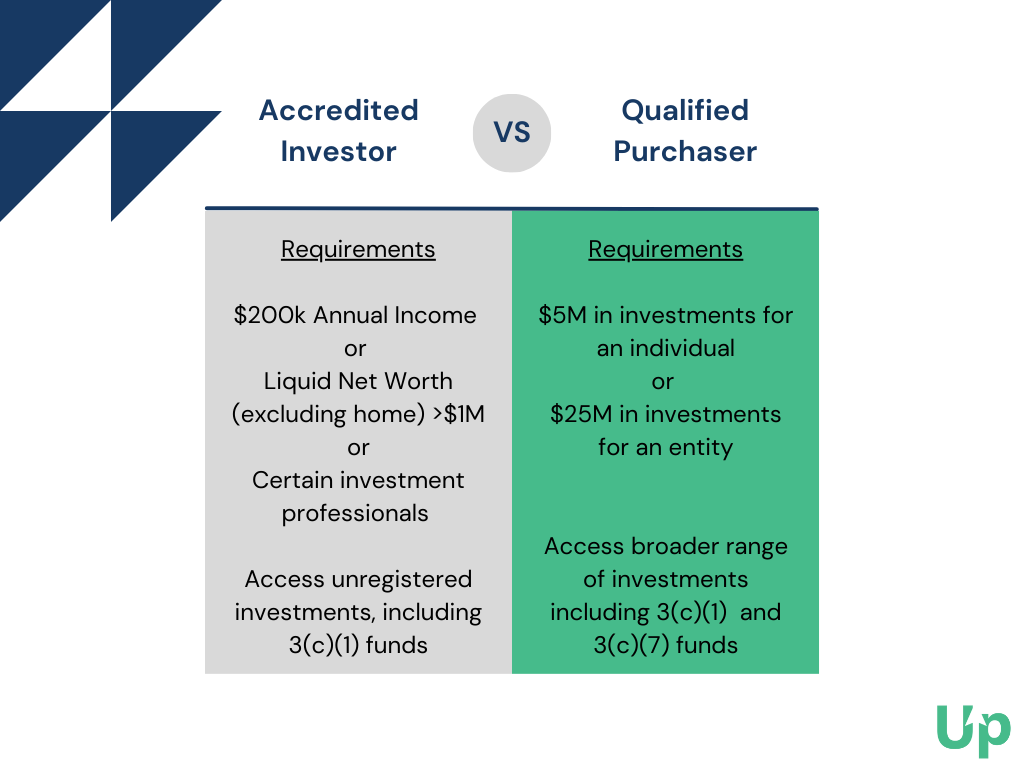

If you want to invest in certain complicated financial investments, the Securities and Exchange Payment (SEC) requires that you be an accredited capitalist. To be accredited, you have to fulfill certain requirements regarding your wide range and earnings along with your financial investment expertise. Take an appearance at the basic needs and benefits of becoming a certified financier.

The SEC takes into consideration that, due to the fact that of their economic security and/or financial investment experience, certified capitalists have much less need for the protection given by the disclosures required of controlled financial investments. The rules for qualification, which have been in location because the Stocks Act of 1933 was developed as a response to the Great Clinical depression, can be discovered in Guideline D, Regulation 501 of that Act.

First-Class Accredited Investor Investment Returns

That organization can not have been developed simply to purchase the non listed safeties in concern. These requirements of revenue, internet well worth, or specialist experience make certain that unskilled financiers do not take the chance of cash they can not afford to lose and do not take financial dangers with investments they don't recognize. No actual accreditation is offered to verify your status as a recognized investor.

When you look for accredited financier condition, you're most likely to undergo a screening process. Documents you will probably have to generate may include: W-2s, tax returns, and other documents verifying incomes over the past 2 years Financial declarations and financial institution statements to confirm internet worth Credit report records Documentation that you hold a FINRA Collection 7, 64 or 82 classification Documentation that you are a "knowledgeable employee" of the entity releasing the safeties The capacity to invest as a "experienced worker" of a fund issuing securities or as a monetary professional holding a proper FINRA permit is brand-new as of 2020, when the SEC expanded its meaning of and certifications for certified financiers.

Investment Platforms For Accredited Investors

These safeties are non listed and unregulated, so they don't have offered the regulative defenses of authorized securities. In general, these financial investments might be particularly volatile or lug with them the possibility for significant losses. They include various organized financial investments, hedge fund financial investments, private equity investments, and various other personal positionings, all of which are unregulated and might bring significant danger.

Of training course, these financial investments are likewise attractive due to the fact that along with included risk, they bring with them the capacity for considerable gains, typically more than those readily available via normal financial investments. Certified capitalists have readily available to them investments that aren't available to the public. These investments include personal equity funds, angel financial investments, specialty investments such as in hedge funds, equity crowdfunding, property mutual fund, equity capital financial investments, and direct investments in oil and gas.

Companies using unregistered securities just have to offer documents regarding the offering itself plus the area and police officers of the firm supplying the securities (private equity for accredited investors). No application procedure is required (as is the case with public supply, bonds, and common funds), and any type of due diligence or extra information offered is up to the business

High-Quality High Yield Investment Opportunities For Accredited Investors for Accredited Investors

This information is not intended to be private recommendations. Possible individuals must talk to their individual tax obligation professional regarding the applicability and result of any kind of and all advantages for their very own individual tax obligation scenario. On top of that, tax laws alter every so often and there is no assurance pertaining to the interpretation of any type of tax obligation legislations.

Approved capitalists (in some cases called professional financiers) have accessibility to investments that aren't readily available to the public. These investments could be hedge funds, hard money lendings, exchangeable investments, or any type of other protection that isn't registered with the monetary authorities. In this post, we're going to focus especially on real estate investment options for certified capitalists.

Table of Contents

- – Top Accredited Investor Secured Investment Opp...

- – Exceptional Venture Capital For Accredited Inv...

- – Professional Real Estate Investments For Accr...

- – First-Class Accredited Investor Investment Re...

- – Investment Platforms For Accredited Investors

- – High-Quality High Yield Investment Opportuni...

Latest Posts

Tax Ease Lien Investments

Tax Foreclosures Listings

Foreclosure Overage

More

Latest Posts

Tax Ease Lien Investments

Tax Foreclosures Listings

Foreclosure Overage